vermont state tax rate

Other local-level tax rates in the. 355 on the first 37450 of taxable income.

States With The Highest And Lowest Property Taxes Property Tax Tax States

State government websites often end in gov or mil.

. It ranges from 600 to 850. Vermont Estate Tax Rate. The major types of local taxes collected in Vermont include income property and sales taxes.

Form BR400 Application for Business Tax Account and Instructions which include. Before sharing sensitive information make sure youre on a state government site. Depending on local municipalities the total tax rate can be as high as 7.

Vermont collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The state sales tax rate in Vermont is 6000. Personal income tax.

Tax Year 2020 Personal Income Tax - VT Rate Schedules. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. 68 on taxable income between.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76. 13750 34 Of the amount over 75000.

Form BR-400A Business Principals with Fiscal Responsibility. Register for Your Tax Account by Mail or Fax. Vermonts income tax rates are assessed over 5 tax brackets.

Page 43 This column also applies to qualifying widower and civil union filing jointly status This column also applies to civil union filing separately status. Marginal Corporate Income Tax Rate. The Vermont VT state sales tax rate is currently 6.

159 of home value. RateSched-2020pdf 11722 KB File Format. These taxes are collected to provide essential state functions resources and programs to.

Vermont sales tax details. The Vermont State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Vermont State Tax Calculator. Tax amount varies by county.

The Vermont Tax Department can determine whether you are eligible for a refund by calling 1-866-828-2865 or 802-828-2865. Like the Federal Income Tax Vermonts income tax allows. State and Federal Unemployment Taxes.

The Vermont Income Tax. California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent.

Overall state tax rates range from 0 to more than 13 as of 2021. State Business Taxes in Vermont. Monday February 8 2021 - 1200.

Vermont Income Tax Rate 2020 - 2021. State unemployment taxes are paid to this Department and deposited. With local taxes the total sales tax rate is between 6000 and 7000.

Understand and comply with their state tax. Meanwhile total state and local sales taxes. 7500 25 Of the amount over 50000.

While many estate taxes are progressive Vermonts is flat. In Vermont property owners are required to pay a. Employers pay two types of unemployment taxes.

Vermont has recent rate changes Fri Jan 01 2021. The state fully taxes income from both retirement accounts like 401k plans and public. The state of Vermont has a Corporate Tax rate with three 3 tax brackets.

Vermont also has a 600 percent to 85 percent corporate income tax rate. The highest tax bracket starts at. The median property tax in Vermont is 344400 per year for a home worth the median value of 21630000.

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Calculator Smartasset

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Sales Tax Rates By City County 2022

Vermont Tax Commissioner Reminds Vermonters To Pay Use Tax Vermont Business Magazine

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

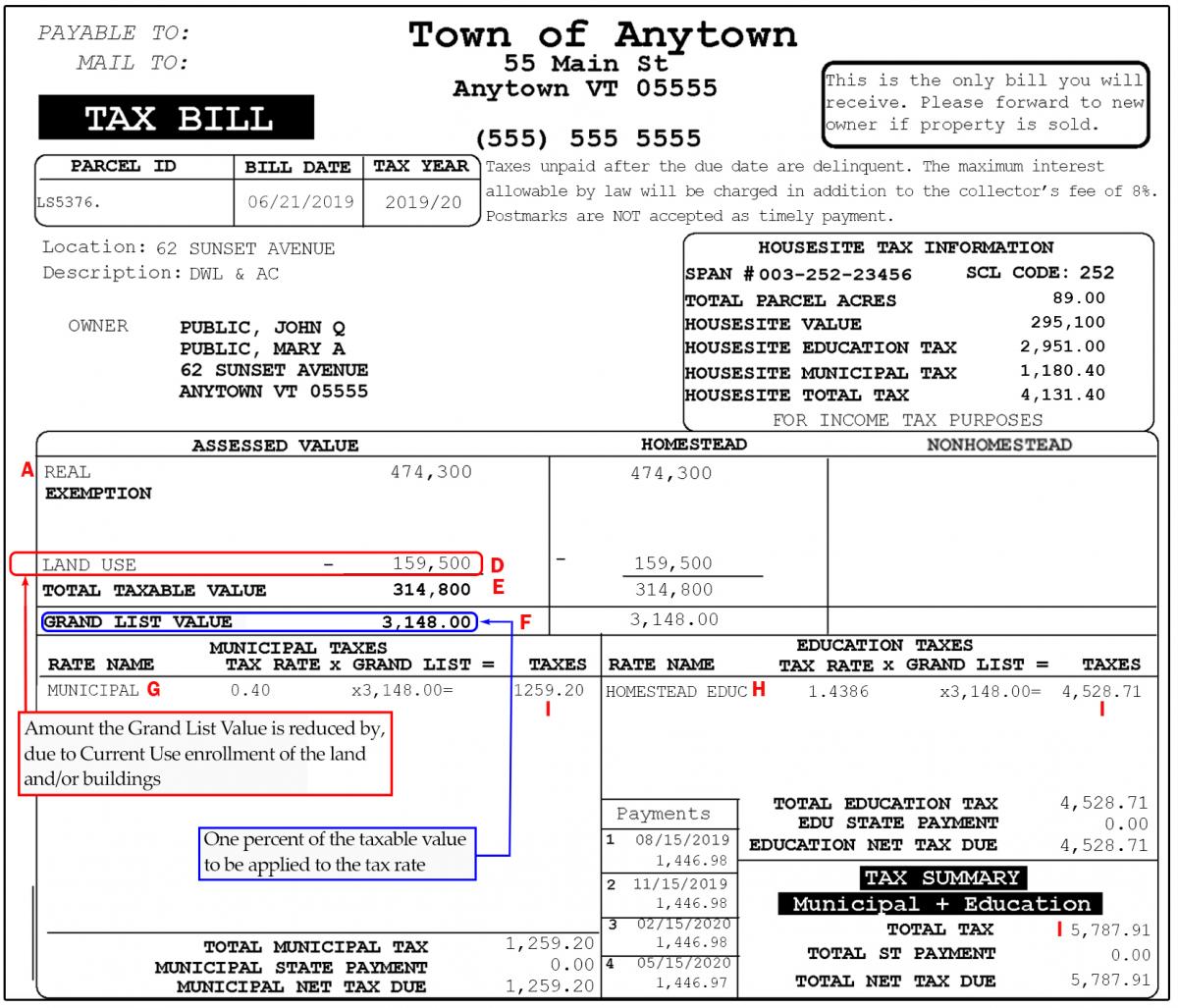

Current Use And Your Property Tax Bill Department Of Taxes

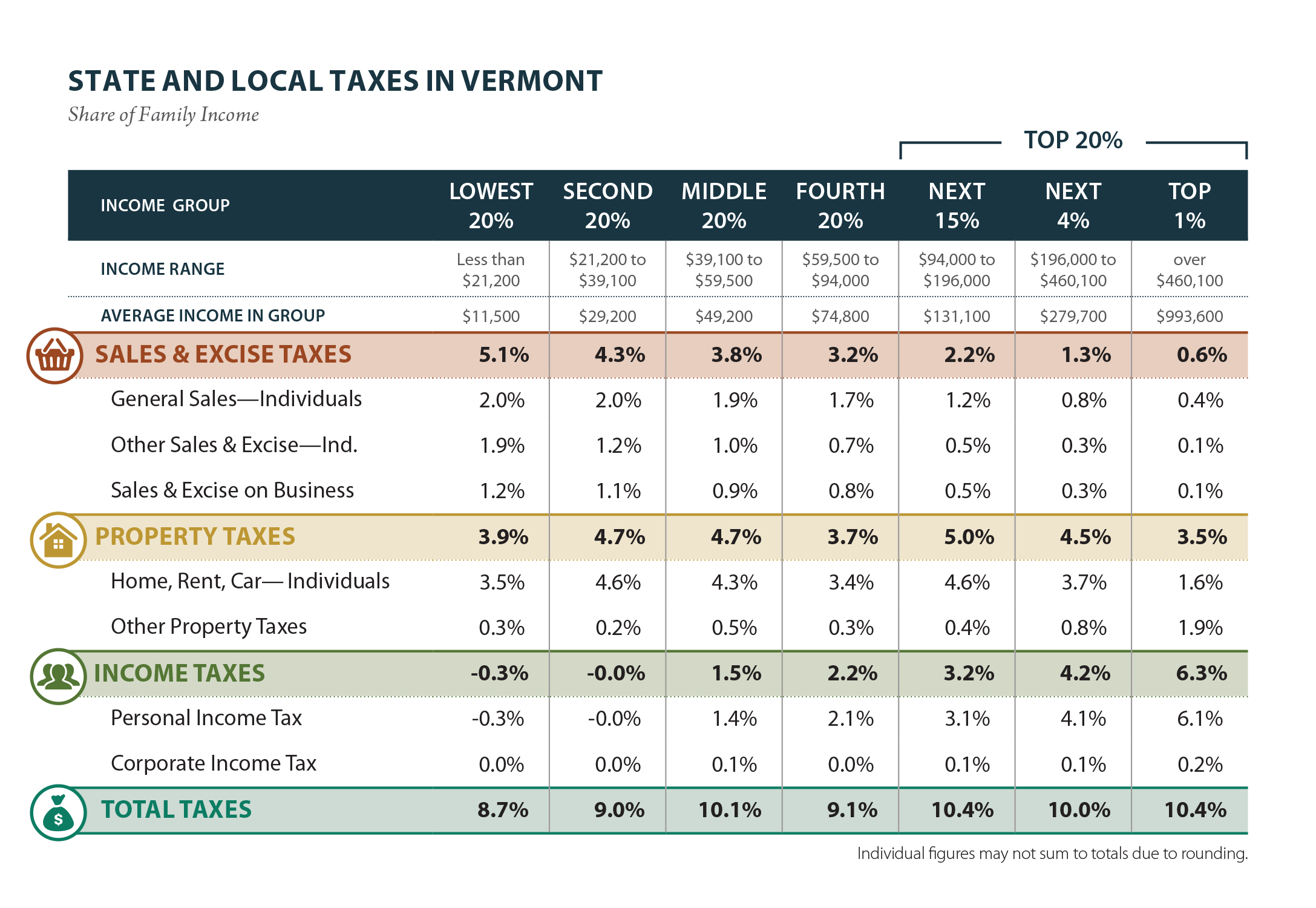

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Income Tax Vt State Tax Calculator Community Tax

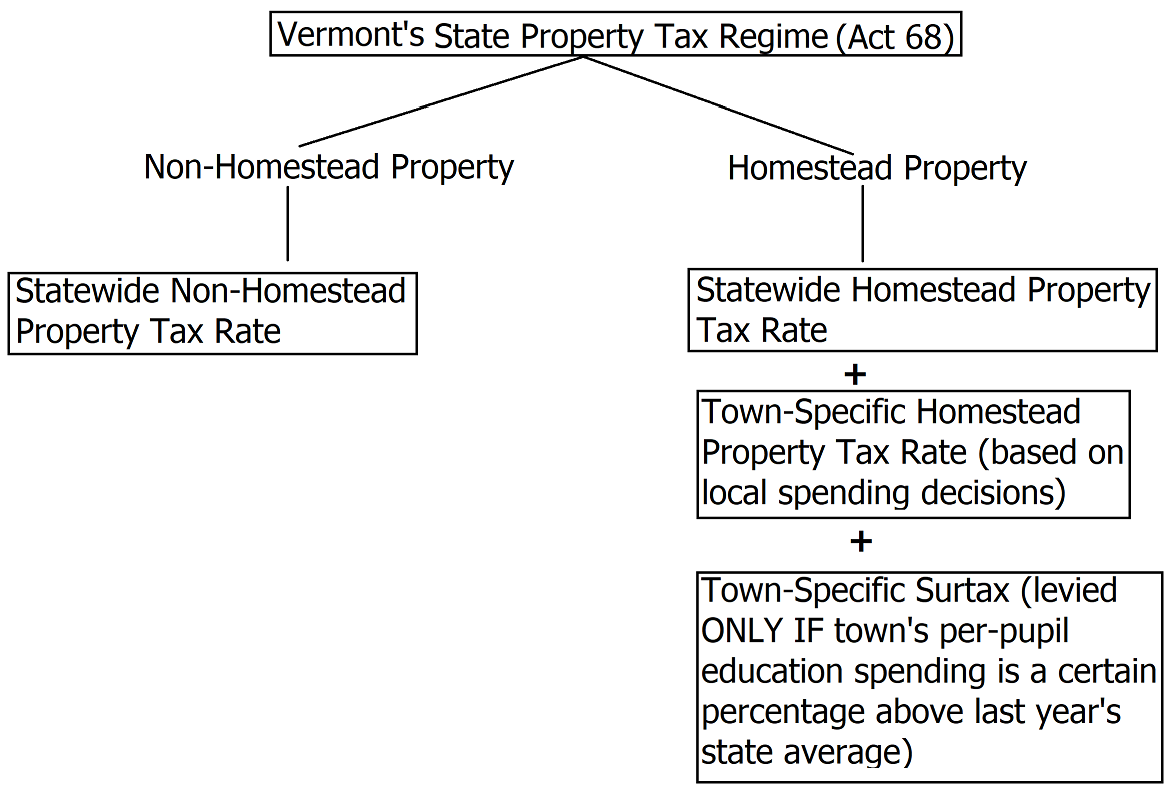

Vermont S School Funding Model Promotes Equity Across School Districts Reason Foundation

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Vermont Property Tax Calculator Smartasset

Vermont State Tax Tables 2021 Us Icalculator

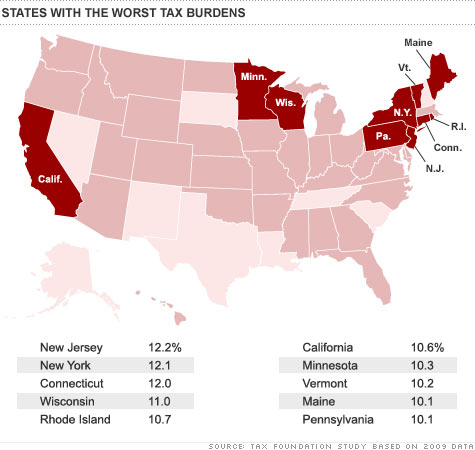

State And Local Tax Burden Falls To 9 8 Of Income In 2009 Feb 23 2011

Top States For Business 2022 Vermont

What Is Behind Montpelier S Property Tax Rate The Montpelier Bridge